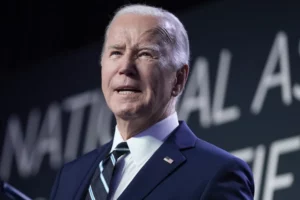

The U.S. dollar gained in late trading on Thursday, after Federal Reserve Chair Jerome Powell said Fed policymakers are not confident that interest rates are yet high enough to finish the battle against inflation.

The dollar index, which measures the greenback against six major peers, rose 0.30 percent to 105.9062 in late trading.

Powell turned hawkish on Thursday, and commented they’re not confident the Fed’s monetary policy is sufficiently restrictive, and said they would not hesitate to tighten monetary conditions if needed.

“We will carefully decide meeting by meeting,” he said, adding that inflation remains well above the 2 percent target despite slowing down.

Powell’s remarks spurred a jump in U.S. Treasury bond yields of more than 10 basis points, boosting the U.S. dollar, but a few strategists still insisted that the Fed is likely done with raising interest rates.

“I don’t think Powell said anything significantly new, but the markets took his comments as somewhat hawkish, yet I think the rates market was still somewhat jittery after the auction so higher yields was the path of least resistance,” said Vassili Serebriakov, FX & Macro strategist at UBS.

“The path to 2 percent is going to be bumpy and the Fed is not convinced that it has done enough. But at this point, Powell’s comments today did not change our view that the Fed is essentially done raising rates and cutting sometime in the middle of next year,” said Angelo Manolatos, rates strategist at Wells Fargo Securities.

In late New York trading, the euro fell to 1.0668 U.S. dollars from 1.0702 U.S. dollars in the previous session, and the British pound was down to 1.2221 U.S. dollars from 1.2283 U.S. dollars.

The U.S. dollar bought 151.3100 Japanese yen, higher than 151.0440 Japanese yen of the previous session. The U.S. dollar rose to 0.9035 Swiss francs from 0.8999 Swiss francs, and it grew to 1.3812 Canadian dollars from 1.3800 Canadian dollars. The U.S. dollar climbed to 10.9132 Swedish krona from 10.9046 Swedish krona.